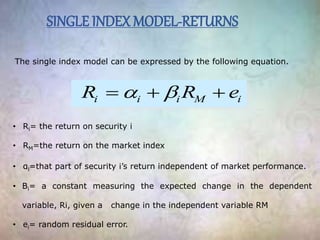

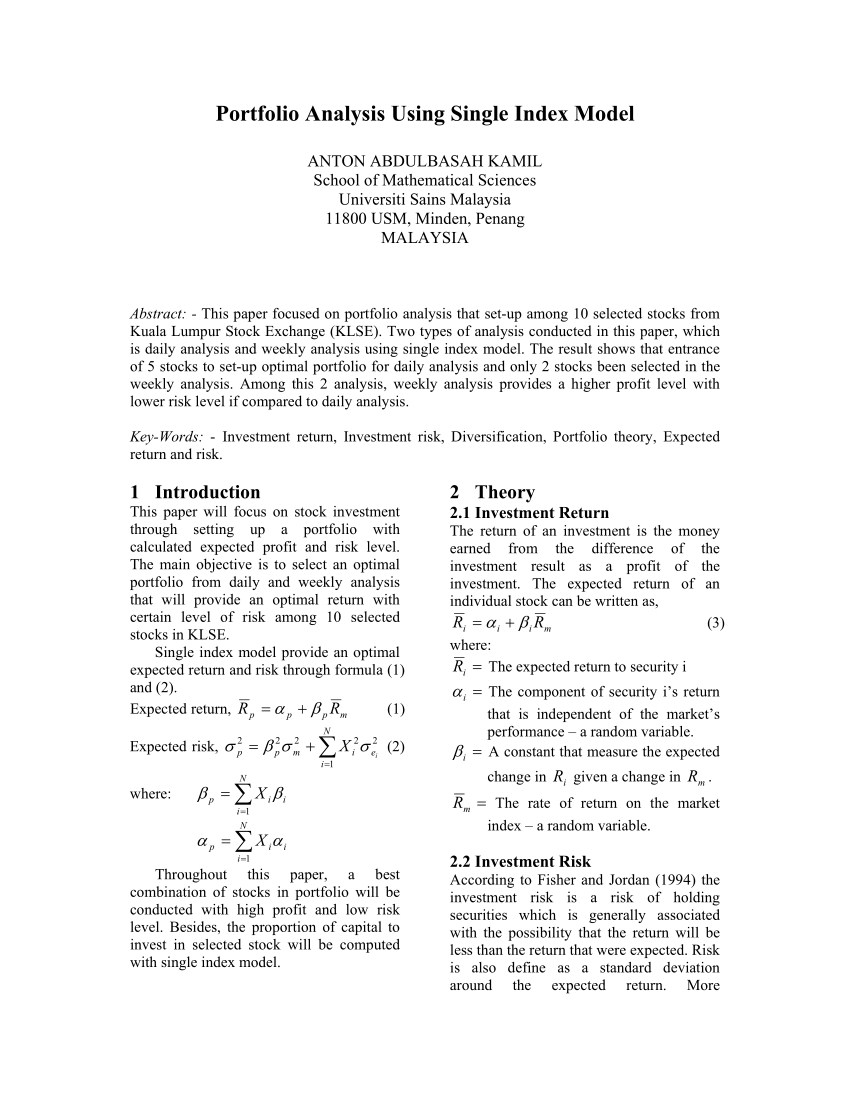

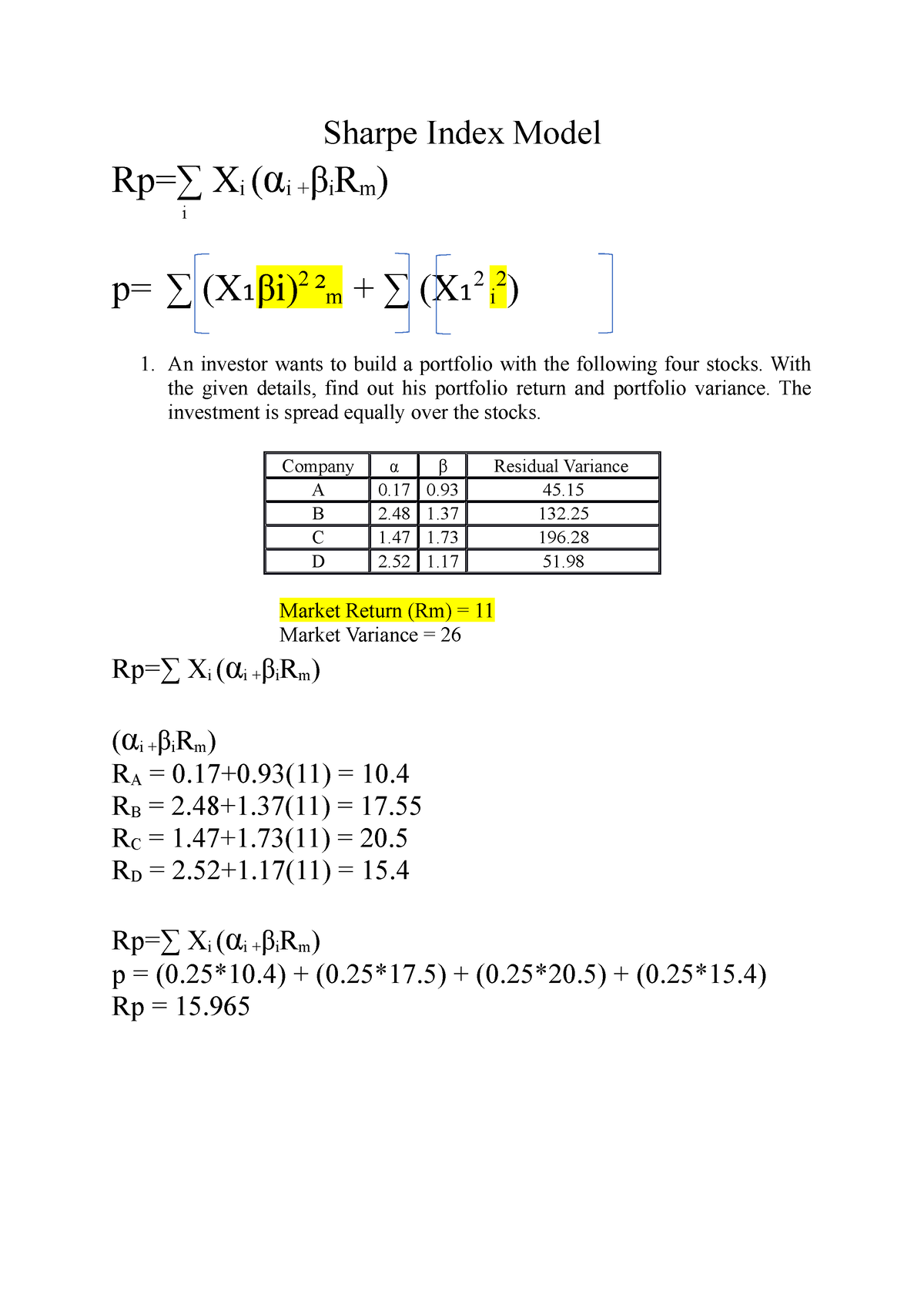

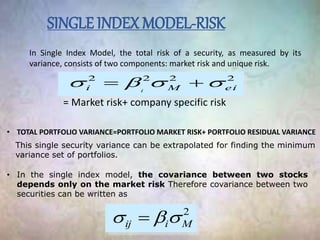

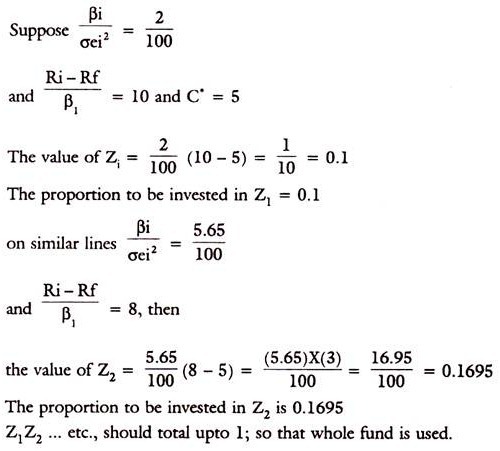

Sharpe Single Index Model - Sharpe Index Model Rp=∑ Xi (αi +βiRm) i p= ∑ (X₁βi) 2 ²m + ∑ (X₁ 2 i 2 ) - Studocu

Sharpe's single index model in Security Analysis and Investment Management Tutorial 06 November 2022 - Learn Sharpe's single index model in Security Analysis and Investment Management Tutorial (11628) | Wisdom Jobs India

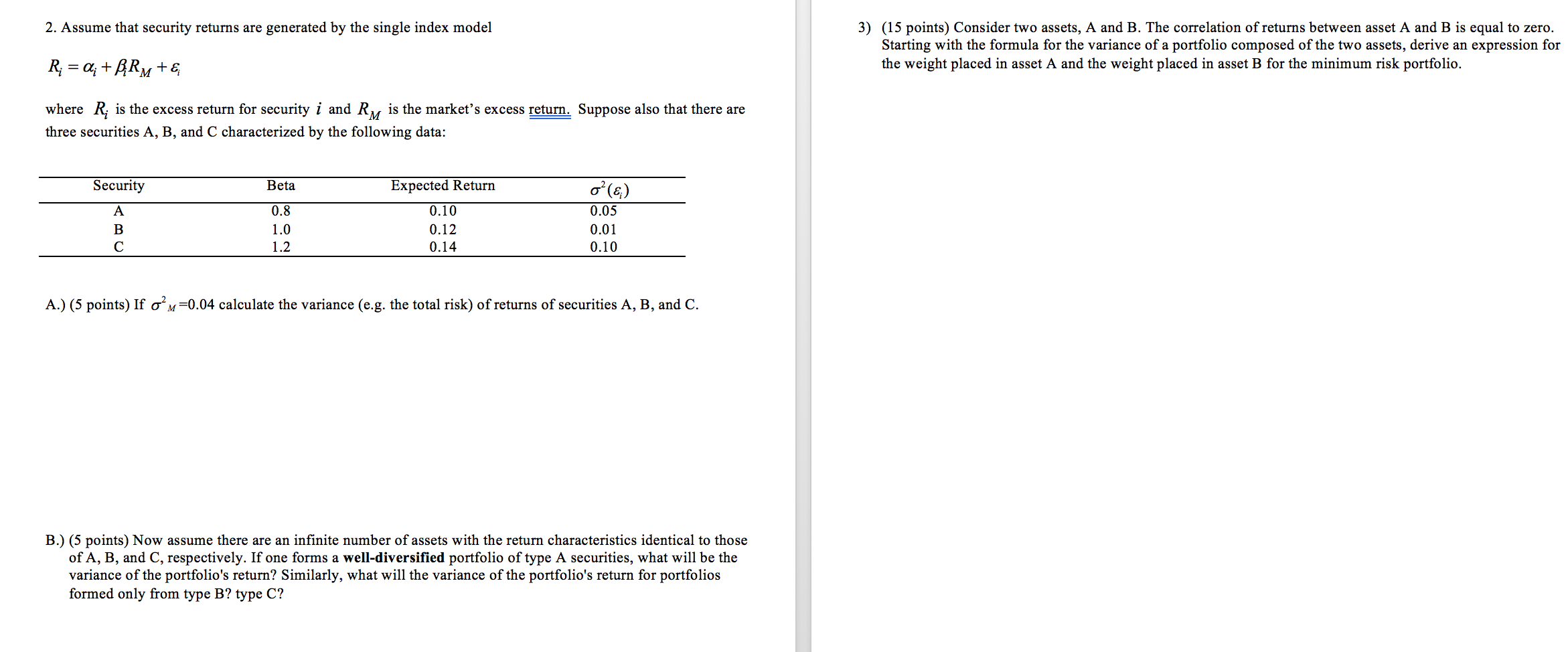

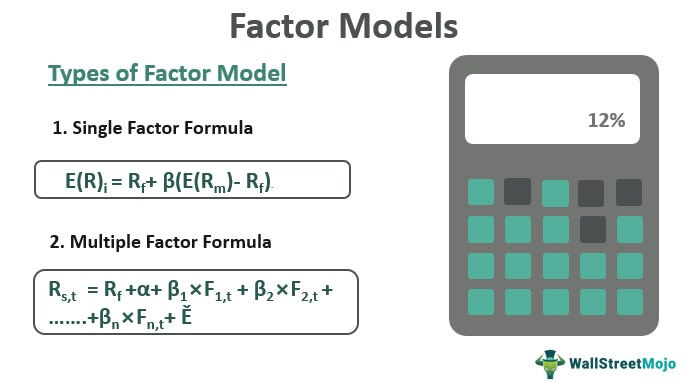

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download

:max_bytes(150000):strip_icc()/Multi-FactorModel_Final_4192607-893ee4d3244c4b7c8506e8dc0f4e81b2.png)